by Kate | Jun 20, 2024 | News

Some of the EBCam team recently attended a business trip in Krakow, Poland. Krakow is a beautiful city with a wealth of history and the largest Medieval square in Europe. After the meetings and business planning we all had some time to explore and there was a wide...

by Kate | Apr 8, 2024 | News

The new tax year which started on 6 April brings a range of changes that could affect your financial planning. Many allowances and tax bands have been frozen once again, with the personal allowance, basic-rate tax band, higher-rate tax band and additional rate...

by Kate | Mar 25, 2024 | News

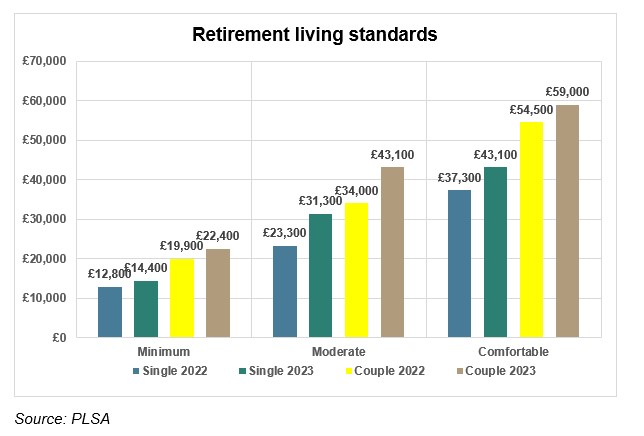

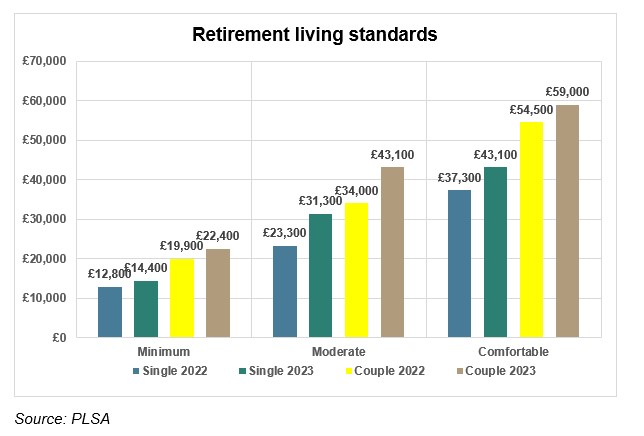

Each year since 2019, the Pensions and Lifetime Savings Association (PLSA) has set about answering the question of how much retirement costs for couples and single retirees. It considers three different Retirement Living Standards, which are summarised as: Minimum:...

by Kate | Mar 21, 2024 | News

Recent research on planned retirement ages has produced some unexpected and perhaps unrealistic results. The next increase in State Pension Age (SPA) to 67 will start to take effect in about two years’ time. Under current legislation the move to a SPA of 68 begins in...

by Kate | Feb 15, 2024 | News

The gender pensions gap is the difference in retirement income between men and women, where women have less pension savings in retirement than men. Could this be true for some of your employees? Or for you? According to the Department for Work and Pension the gender...