by Kate | Dec 12, 2024 | News

The latest Budget move to include pensions as part of your estate for inheritance tax (IHT) is a major change, with potentially significant consequences. At present, most pension benefits payable on death, whether lump sums or other income, are outside the scope of...

by Kate | Nov 21, 2024 | News

The Institute for Fiscal Studies (IFS) has been looking at the numbers on the adequacy of pension contributions. Assumptions behind the percentage of earnings that pensions need to replace in retirement have been revisited – and the outcomes may mean you should...

by Kate | Oct 31, 2024 | News

In presenting Labour’s widely anticipated first Budget in 14 years, the Chancellor, Rachel Reeves, was faced with a challenging task. Following her announcement of a “black hole” in the public finances, the need to renew the Treasury’s coffers while maintaining...

by Kate | Sep 16, 2024 | News

We are delighted to announce that Aaron has joined the team at EBCam as a Trainee Employee Benefits Administrator. Aaron has a degree in Biomedicine from the University of East Anglia and a keen interest in computer science and technology, including flexible benefit...

by Kate | Jul 11, 2024 | News

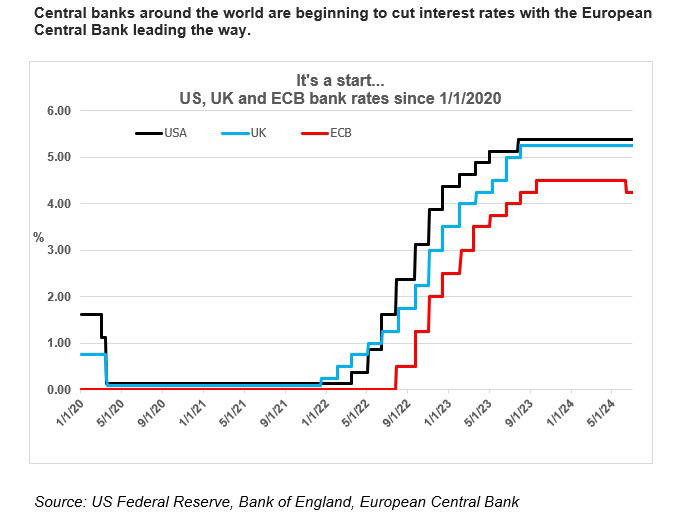

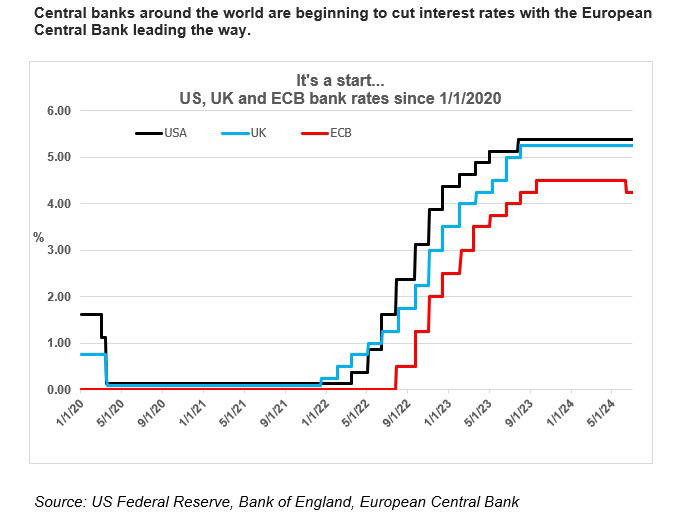

On 6 June 2024, the European Central Bank (ECB) became the first major central bank (the big three being the US, UK and European) to announce an interest rate cut in the current cycle. This marked the ECB’s first cut since September 2019, when its main rate was...

by Kate | Jul 1, 2024 | News

Recently, I joined EBCam to experience a week of work alongside the team, to help me grasp an understanding of how they provide favourable financial services. The EBCam team have shown me situations they face on a day-to-day basis by allowing me to involve myself in...