OUR BLOG

New tax year – new opportunities

The new tax year which started on 6 April brings a range of changes that could affect your financial planning. Many allowances and tax bands have been frozen once again, with the personal allowance, basic-rate tax band, higher-rate tax band and additional rate...

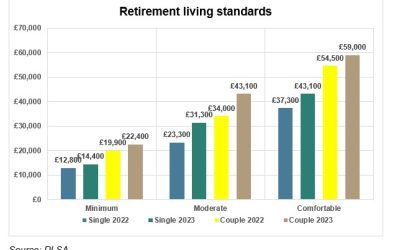

Retirement Living Standards

Each year since 2019, the Pensions and Lifetime Savings Association (PLSA) has set about answering the question of how much retirement costs for couples and single retirees. It considers three different Retirement Living Standards, which are summarised as: Minimum:...

The Retirement Procrastination Problem

Recent research on planned retirement ages has produced some unexpected and perhaps unrealistic results. The next increase in State Pension Age (SPA) to 67 will start to take effect in about two years’ time. Under current legislation the move to a SPA of 68 begins in...

The Gender Pension Gap

The gender pensions gap is the difference in retirement income between men and women, where women have less pension savings in retirement than men. Could this be true for some of your employees? Or for you? According to the Department for Work and Pension the gender...

The National Insurance Tax Cut

For employees, the national insurance cut announced in the Autumn Statement took effect on 6 January 2024. For many years, successive governments have been happy for the public to vaguely believe that national insurance contributions (NICs) are building up in some...

Payrolling Employer-Provided Benefits

Do you currently payroll your benefits-in-kind (BIK)? HMRC has announced that payrolling benefits, and paying class 1A NIC on benefits-in-kind (BIK) via payroll, will be mandatory from April 2026. This will reduce administrative burdens by simplifying and digitising...