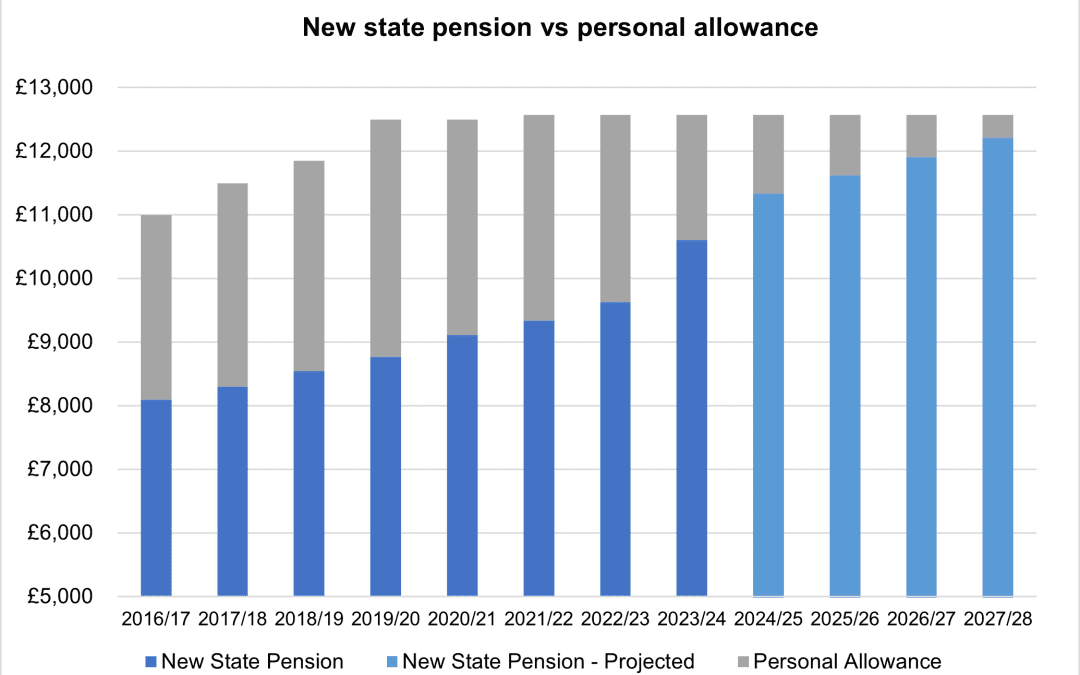

Did you know that the personal allowance will remain frozen at £12,570 up to and including 2027/28 – a total freeze of six tax years.

This compares to the new state pension, payable to eligible individuals who reached their State Pension age after 5 April 2016, which will rise by 10.1% to £203.85 a week in April 2023 – that is £10,600 a year. The increase is once again in line with the ‘Triple Lock’, which increases the main state pensions by the greatest of:

· consumer price index (CPI) inflation;

· earnings growth; and

· 2.5%.

What does this mean? It is possible that the new state pension could be larger than the personal allowance in 2027/28. This would cause problems for HMRC, because although the state pension is taxable, it is paid without deduction of tax.

The chart shows the new state pension from when it began in 2016/17 to 2023/24 (dark blue) and the Office for Budget Responsibility’s (OBR) projections for the level over the following four years (light blue). The grey element shows the gap between the personal allowance and state pension in each tax year. In 2019/20, the personal allowance was over £3,700 higher than the new state pension. If – a big if – the OBR’s crystal ball is wholly accurate, then by 2027/28 the difference will only be about £360 – less than a tenth as much.

Of course, it may not happen – 2027/28 is well after the next election, for a start. However, it is a reminder both of how the income tax screw is being turned tighter and why income tax planning is becoming ever more important.

Source: DWP, HMRC, OBR

Tax treatment varies according to individual circumstances and is subject to change. The Financial Conduct Authority does not regulate tax or benefit advice